In today's fast-paced monetary landscape, many individuals discover themselves in want of fast access to funds with out the prolonged and sometimes hectic strategy of traditional credit checks. Loans with month-to-month payments and no credit check have emerged as a viable answer for individuals who might not qualify for conventional loans attributable to poor credit score historical past or lack of credit altogether. This case examine will explore the mechanisms, advantages, dangers, and implications of these loans, providing a complete understanding for potential borrowers.

The Idea of No Credit Check Loans

No credit check loans are monetary products that allow borrowers to entry funds with out the lender performing a conventional credit score evaluation. Instead of evaluating a borrower's credit rating, lenders could consider other factors reminiscent of income, employment status, and financial institution statements. This strategy permits individuals with much less-than-excellent credit histories to secure financing shortly.

Forms of No Credit Check Loans

- Payday Loans: These are brief-time period loans designed to cover fast expenses until the borrower receives their next paycheck. They usually include excessive-curiosity charges and charges, making them a expensive option if not repaid rapidly.

- Installment Loans: Not like payday loans, installment loans permit borrowers to repay the amount borrowed in fastened month-to-month funds over a specified period. These loans could be for varied amounts and are often used for bigger purchases or unexpected expenses.

- Title Loans: Title loans use the borrower's car as collateral. The loan quantity is based on the car's value, and if the borrower fails to repay, the lender can repossess the car.

- Personal Loans from Different Lenders: Some online lenders offer personal loans with out credit score checks, focusing as a substitute on revenue verification and employment status. These loans usually have more versatile phrases than payday loans.

Benefits of No Credit Check Loans

- Accessibility: The primary advantage of no credit check loans is their accessibility. People with poor credit or no credit historical past can obtain loans, which can be not possible by means of conventional lenders.

- Fast Approval: The appliance process for no credit check loans is commonly streamlined, permitting borrowers to obtain funds within a brief timeframe—sometimes within hours of making use of.

- Flexible Use: Borrowers can use the funds from these loans for varied purposes, including medical bills, automotive repairs, or unexpected expenses.

- Much less Demanding Utility Course of: The absence of get a loan no credit check online credit score check simplifies the applying course of, decreasing the anxiety associated with conventional loan purposes.

Dangers and Issues

While no credit check loans provide important benefits, additionally they include inherent dangers that borrowers should consider:

- High-Curiosity Charges: Many no credit check loans, significantly payday loans, include exorbitant interest rates and charges. If you enjoyed this article and you would certainly such as to obtain more details pertaining to apply for a small loan no credit check kindly go to the web-site. Borrowers might discover themselves in a cycle of debt if they cannot repay the loan on time.

- Short Repayment Phrases: The repayment phrases for these loans are sometimes quick, requiring borrowers to pay back the whole quantity rapidly. Failure to do so can lead to extra fees and additional financial pressure.

- Potential for Predatory Lending: Some lenders could have interaction in predatory practices, focusing on weak borrowers with deceptive terms and situations. It is important for borrowers to read the fine print and understand the overall value of borrowing.

- Impression on Financial Well being: Relying on no credit check loans can result in a cycle of debt, the place borrowers frequently take out new loans to pay off present ones, finally harming their financial health.

Case Examine: Sarah's Experience with a No Credit Check Loan

As an instance the impression of no credit check loans, consider the case of Sarah, a 28-12 months-previous single mother who recently misplaced her job. Facing mounting payments and an pressing must restore her automotive to safe a new job, Sarah turned to a payday loan supplier for assistance.

After filling out a easy on-line utility, Sarah was accepted for a $500 payday loan with an interest charge of 400% APR. The lender required her to repay the loan within two weeks, coinciding along with her next paycheck. Determined for funds, Sarah accepted the phrases with out fully understanding the implications.

When payday arrived, Sarah realized that the 200 loan today no credit check repayment consumed a major portion of her paycheck, leaving her with little 300 cash loan no credit check for dwelling expenses. Faced with fast monetary pressure, she opted to take out another payday loan to cover her remaining bills, creating a cycle of borrowing that spiraled out of control.

Inside a few months, Sarah found herself in a precarious financial state of affairs, struggling to make ends meet whereas juggling multiple loans. The excessive-curiosity rates compounded her debt, resulting in stress and anxiety.

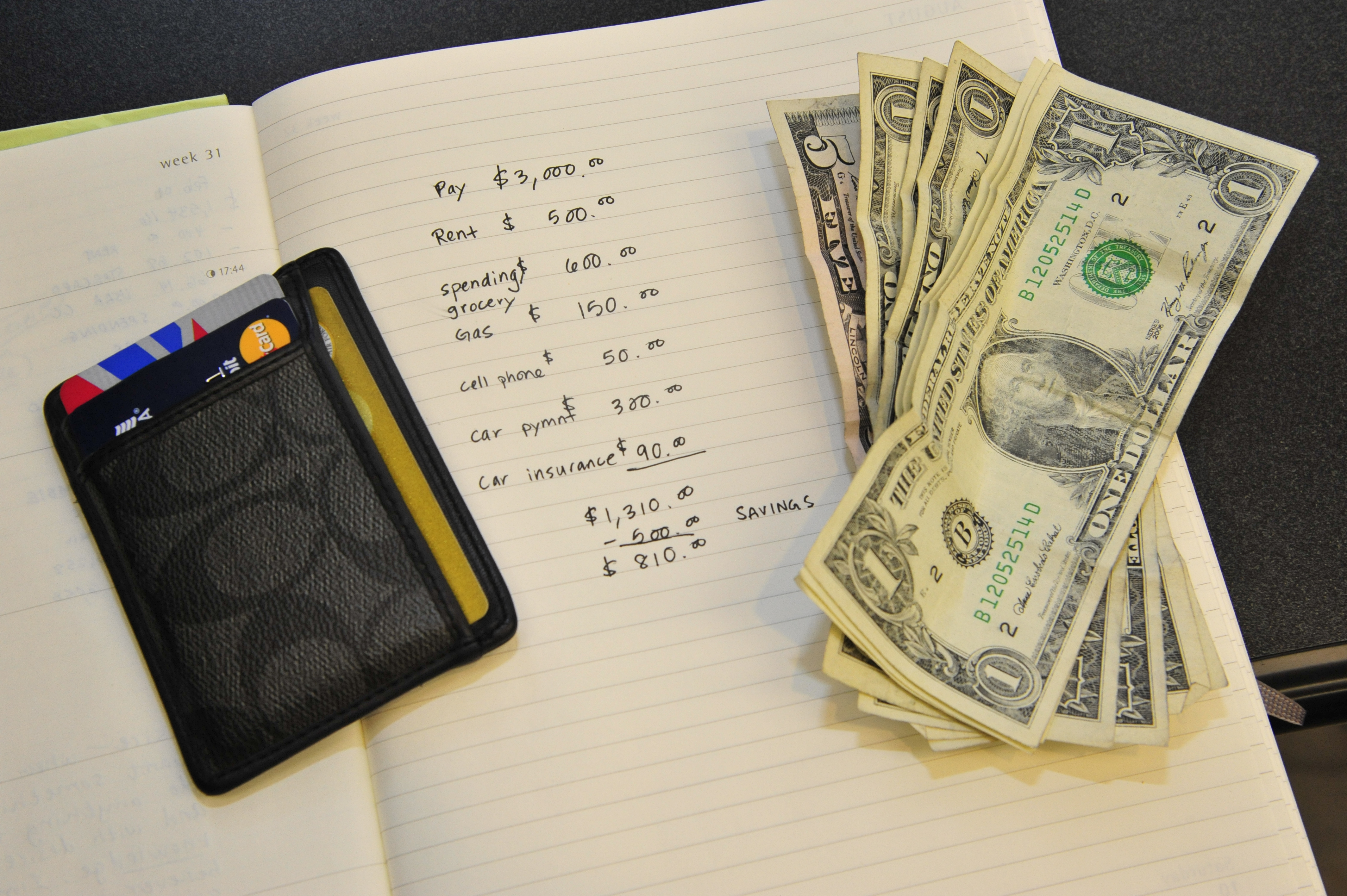

Recognizing the need for change, Sarah sought monetary counseling. With the assistance of a monetary advisor, she developed a budget, realized about different lending choices, and explored neighborhood assets for help. Over time, she managed to repay her loans and rebuild her credit.

Conclusion

Loans with monthly payments and no credit check can present important financial help for people in need, notably these with poor credit score histories. However, the risks related to these loans cannot be ignored. Borrowers should train caution, conduct thorough analysis, and consider different options before committing to a loan.

As Sarah's experience illustrates, it's crucial for individuals to grasp the terms of their loans, the overall price of borrowing, and the potential long-term results on their financial well being. By making knowledgeable choices and in search of recommendation when needed, borrowers can navigate the complexities of no credit check loans and work in direction of reaching monetary stability.